Updated: 30 September, 2025

12 February, 2025

Fraud against government programs costs taxpayers billions of dollars every year, threatening the integrity of essential services and programs. The False Claims Act (FCA) is one of the most powerful tools in the fight against such fraud, empowering the government and private individuals to hold people accountable.

In this comprehensive guide, we’ll explore the purpose and impact of the False Claims Act, shedding light on its history, key provisions, different industries, and, most importantly, its relevance in ensuring security compliance for vendors working with the U.S. government. Whether you’re a whistleblower considering your options or an organization aiming to ensure compliance, understanding the FCA is crucial to navigating this critical area of law.

Key takeaways:

- The False Claims Act holds vendors accountable for knowingly misrepresenting their work, services, or compliance to improperly receive government payments.

- The law has evolved to empower whistleblowers, allowing them to expose fraud, trigger legal and financial consequences, and receive compensation for their role.

- The FCA enforces security compliance for government contractors, holding them accountable for falsely certifying adherence to standards.

- Implementing strong cybersecurity measures, clear documentation, and regular audits helps organizations avoid FCA-related penalties and strengthen overall compliance

- SAMMY provides a structured and controlled approach to security maturity, helping organizations align with regulatory frameworks and minimise FCA related risks.

What is the False Claims Act and why is it important?

The False Claims Act is a federal law designed to combat fraud against the U.S. government. The FCA holds individuals and organizations accountable for knowingly submitting false or fraudulent claims for government funds. This could include overcharging for services, billing for goods not provided, or providing substandard products under government contracts. Importantly, the FCA also applies to security compliance, if a vendor falsely certifies adherence to security standards required by federal contracts, they can face significant consequences under the FCA.

The False Claim Act has served a very important part in holding individuals and organizations accountable, ensuring that funds are used as intended. Violators of the FCA face steep penalties, including hefty fines and repayment of up to three times the amount defrauded. Organizations also risk a potential disqualification from any future government contracts, which in some cases can be worse than a financial consequence. In fiscal year 2023 alone, over $2.68 billion was recovered through FCA enforcement, emphasizing the law’s critical role in protecting government resources.

The law’s qui tam provision allows private citizens, known as whistleblowers, to report fraud and file lawsuits on behalf of the government. This mechanism has been vital in detecting fraud and recovering funds, particularly in industries where security compliance is paramount.

The History and evolution of the False Claims Act

The False Claims Act was originally passed in 1863 during the U.S. Civil War to address widespread fraud against the Union Army. At that time, suppliers were submitting false claims for goods that were either defective or never delivered, leading to significant losses for the government. To combat this, Congress created the FCA, enabling whistleblowers to report fraudulent activities and hold wrongdoers accountable.

Over the years, the FCA has evolved to adapt to new challenges and expand its scope. In 1986, major amendments to the law strengthened penalties for violations and expanded the qui tam provision, which allows private individuals to file lawsuits on behalf of the government. This amendment incentivized whistleblowers by offering them a portion of the recovered funds, increasing the law’s effectiveness in uncovering fraud. Today, the FCA is increasingly used to enforce compliance with federal security standards

How does the False Claims Act relate to security compliance?

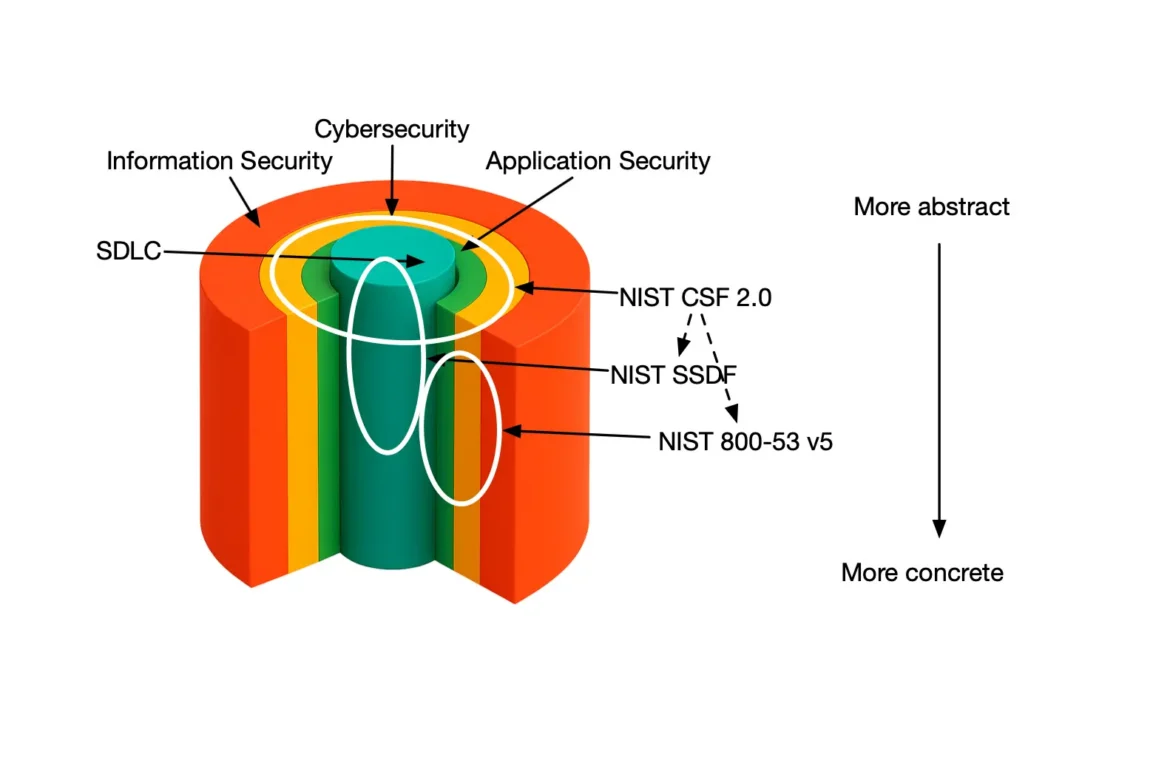

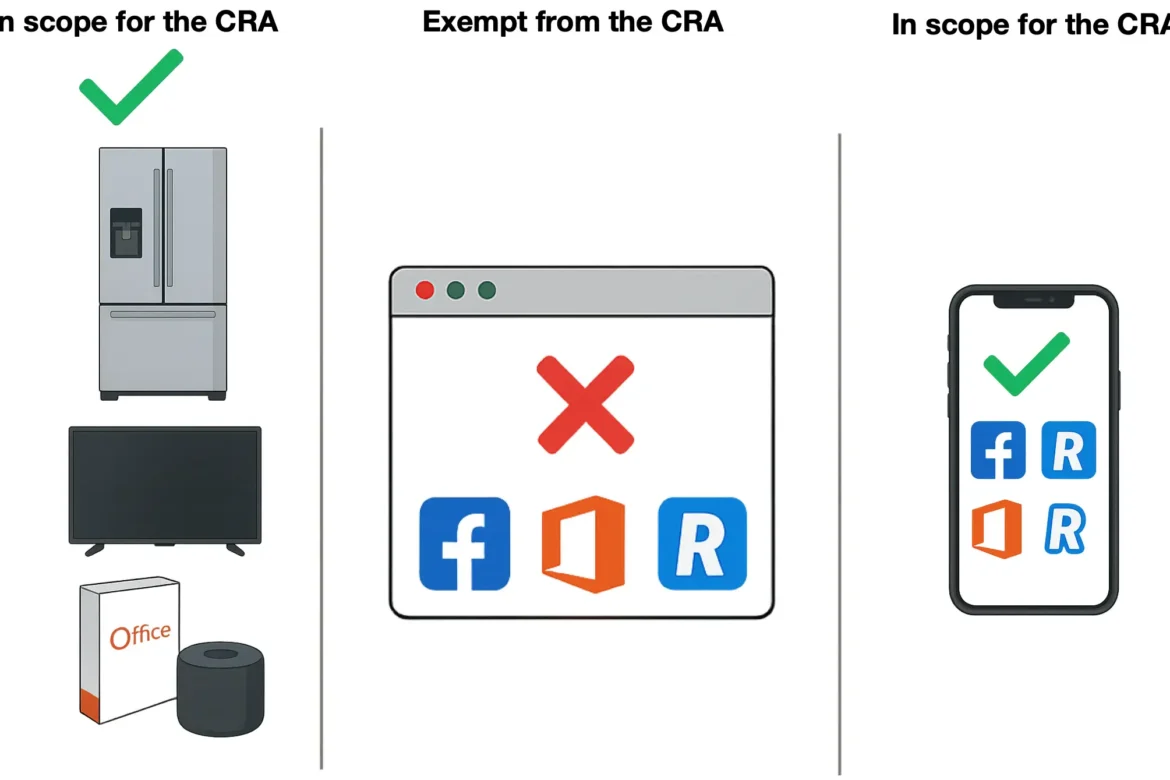

The FCA plays a critical role in enforcing security compliance for organizations working with the US government. Vendors and contractors are often required to adhere to strict security standards, such as the Federal Information Security Management Act (FISMA) or frameworks from NIST, to protect sensitive data and systems. The FCA becomes applicable when organizations falsely certify compliance with these standards.

Key areas where FCA enforcement intersects with security compliance include:

- Falsified certifications: Claiming compliance with FISMA, NIST, or other security frameworks without implementing required controls.

- Negligence in security measures: Failing to protect government data as stipulated in contracts.

- Fraudulent reporting: Providing inaccurate security audit results or withholding information about vulnerabilities.

- Misguided self-certification: Vendors may self certify compliance, but without deep expertise, they risk unknowingly falling short. An example of this is: NIST SSDF requires in-depth application security knowledge. A superficial implementation of NIST SSDF can expose the entire organization to risk.

These violations not only lead to FCA penalties but also undermine trust in critical government programs.

Key features and provisions of the False Claims Act

The FCA’s effectiveness in combating fraud, including security-related violations, stems from several key features:

-

Liability and Fraudulent Claims

The FCA holds individuals and organizations liable for knowingly submitting false or fraudulent claims for government funds or property. This includes actions such as:

- Overbilling or charging for goods or services not provided.

- Misrepresenting compliance with contract terms or regulations.

- Concealing or avoiding repayment of government overpayments.

Liability extends to those who knowingly cause others to submit false claims, ensuring all participants in fraudulent schemes are accountable.

-

Penalties and Damages

Violators face significant financial consequences under the FCA, including:

- Civil penalties ranging from $13,508 to $27,018 per false claim, adjusted for inflation.

- Treble damages, meaning violators must repay up to three times the government’s financial losses.

These penalties act as a strong deterrent and ensure that fraudulent actions are not financially beneficial.

-

The Whistleblower (Qui Tam) Provision

The FCA empowers whistleblowers to file lawsuits on behalf of the government through the quim tam provision. If successful, whistleblowers may receive 15% to 30% of the recovered funds as a reward. This provision has been instrumental in uncovering fraud, as whistleblowers often have insider knowledge of fraudulent activities.

Real-World Applications: Industries and common violations

The False Claims Act (FCA) has been instrumental in addressing fraudulent activities across various industries. Notably, the healthcare and defense sectors have seen significant enforcement actions due to their extensive interactions with government programs.

-

Healthcare Industry

In the healthcare sector, common FCA violations include:

- Billing for services not rendered: Submitting claims for medical procedures or services that were never provided.

- Upcoding: Charging for more expensive services than those actually performed.

- Kickbacks and unlawful referrals: Engaging in financial arrangements that incentivize referrals, violating anti-kickback statutes.

Example: In 2006, Tenet Healthcare agreed to a $900 million settlement over allegations of billing violations, including manipulation of outlier payments to Medicare, kickbacks, upcoding, and bill padding.

-

Defense Industry

The defense sector has faced FCA cases involving:

- Overcharging for goods and services: Billing the government at inflated prices.

- Defective products: Supplying substandard equipment or materials that fail to meet contract specifications.

Example: In 2024, Dell agreed to pay $2.3 million to settle allegations of overcharging the U.S. Army for computer equipment between May 2020 and April 2024.

-

Cybersecurity

Also relating to defense, there are many FCA cases involving security-related violations with organizations claiming to comply with certain security controls and requirements.

Example: Pennsylvania State University Settlement in October 2024 agreed to pay $1.25 million to resolve allegations of failing to comply with cybersecurity requirements in contracts with the Department of Defense (DoD) and NASA. The university allegedly did not adhere to mandated cybersecurity controls, potentially compromising sensitive information.

Example 2: in 2024, Verizon Verizon Business Network Services agreed to pay over $4 million to settle FCA allegations that it failed to fully implement required cybersecurity controls in services provided to federal agencies. The company cooperated with the government during the investigation.

-

Other Sectors

Beyond healthcare and defense, the FCA has been applied in industries such as:

- Education: Addressing fraudulent claims for federal student aid.

- Construction: Tackling false certifications regarding compliance with contract requirements.

- Financial services: Confronting fraudulent loan applications and misrepresentations in federally insured programs.

These real-world applications demonstrate the FCA’s broad reach in combating fraud across multiple sectors, ensuring the integrity of government expenditures and protecting taxpayers funds.

How to stay compliant with the False Claims Act

Ensuring compliance with the False Claims Act (FCA) is essential for organizations that engage in business with the U.S. government. Adhering to the following best practices can help prevent violations and promote a culture of integrity:

-

Develop a comprehensive compliance program

Establish clear policies and procedures: create detailed guidelines that address contractual obligations.

Conduct regular training: educate employees about FCA requirements and the importance of compliance. Training should be ongoing to keep staff informed about any change in regulations.

Perform routine audits: regularly review internal processes and transactions to detect the correct potential compliance issues before they

-

Foster a culture of transparency and accountability

Encourage employees to prioritize compliance and report concerns without fear of retaliation.

Maintain detailed records: Document all compliance activities, including training and audits, to demonstrate adherence to security obligations.

-

Conduct due diligence

Evaluate the compliance and practice of partners, subcontractors and suppliers to mitigate risks associated with third-party relationships.

-

Maintain robust security practices

Implement strong security measures. Adhering to cybersecurity standards such as OWASP SAMM, NIST, compliance frameworks such as ISO 27001 will help your organisation protect data.

While these frameworks are not specifically designed to address the False Claims Act, they can help organisations stay compliant by providing a structured approach to managing security, data integrity, and risk. This is important because violations of the FCA often stem from issues like fraudulent reporting, billing errors, or mishandling of sensitive information – areas where these frameworks can significantly mitigate risks.

Stay updated on new regulations and requirements to ensure ongoing compliance, this is necessary in all cases but is critical when handling government contracts.

-

Don’t lie to the government

This might sound obvious…… but it’s worth saying – don’t lie to the government. Seriously. Misrepresenting compliance, cutting corners, or altering reports isn’t just unethical; it can lead to hefty fines, legal trouble, and potentially being excluded from future contracts. If you’re unsure about compliance, get expert advice (like us) ;).

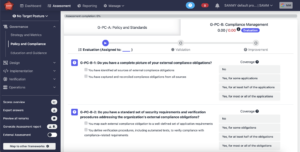

How can SAMMY help?

SAMMY, our AppSec Program Management tool (with a free version), originally designed for OWASP SAMM now supports multiple security maturity and compliance frameworks. These include NIST SSDF, NIST CSF 2.0, BSIMM14, and more that you can find here.

Using SAMMY allows your organization to align its security practices with established standards, ensuring a robust defense against vulnerabilities that could lead to FCA violations.

The tool facilitates thorough assessments of your security activities, providing maturity scores across various business functions and security practices. It also gives organisations the ability to assign specific roles for security tasks. By clearly defining responsibilities, it ensures that all aspects of your security program are managed effectively, helping reduce the risk of oversight.

SAMMY offers quantitative prioritization of security activities based on industry relevance, priority weighting, and identified gaps. This feature helps in creating a structured roadmap for security improvements, allowing your organization to address the most critical areas first, thereby enhancing overall compliance efforts.

By introducing SAMMY into your security management processes, your organization can systematically strengthen its cybersecurity measures, thereby supporting adherence to the False Claims Act and mitigating risks associated with non-compliance.

We also recommend our partner Conquest Security for compliance certifications with the US. For high-stakes contracts or critical systems, third-party assessments offer credibility and thoroughness, minimizing compliance risks.

Official Resources